March 1, 2015 Vol. 105

Week in Review

Stocks modestly higher; Nasdaq nears record territory

Most of the major benchmarks established record highs on Friday, before falling back a bit to end the week mixed. At its peak on Friday, the Nasdaq stood within roughly 2.8% of the all-time intraday high it established in March 2000, although the index remained well below its peak on an inflation-adjusted basis. The small-cap Russell 2000 Index also performed well and ended the week with better year-to-date gains than the large-cap benchmarks—a notable break from its relatively poor performance in 2014.

Dovish Fed boosts sentiment

Although price swings were relatively moderate in either direction, the Standard & Poor’s 500 Index saw its biggest gains on Tuesday, following Federal Reserve Chair Janet Yellen’s appearance before Congress. Many investors interpreted her comments as supportive of continued low interest rates and thus higher stock multiples (price-to-earnings ratios). Some were particularly encouraged to hear Yellen’s assurance that any small change in the Fed’s post-meeting statements-which have stated that policymakers will be “patient” in normalizing monetary policy—should not be interpreted as a sign of impending rate increases.

Energy stocks lag as oil prices tumble on Thursday

Energy stocks performed poorly at the end of the week, due mainly to a sharp drop in oil prices on Thursday. A rise in U.S. inventories sent the price of West Texas Intermediate crude down over 5% for the day, even as global oil prices held on to recent gains due to declining production in Iraq, Libya, and elsewhere. Overall U.S. production has remained surprisingly robust, as producers have mainly chosen to take unproductive rigs offline. Energy portfolio managers and analysts believe that lower prices will eventually weed out the more inefficient producers, while stronger competitors will also benefit from the declining cost of extraction.

Good news about business spending, but consumer likely to drive growth in 2015

The week’s economic data were mixed and did not appear to play a major role in driving sentiment. The government announced Friday that the economy had grown a little less than first estimated in the final quarter of 2014, even as consumer spending increased at its fastest pace in nearly four years. Some economists note that a decline in inventory building was largely to blame for the downward revision, while business capital spending actually increased considerably more than first estimated.

Yellen testimony eases concerns about timing of initial Fed rate hike

Federal Reserve Chair Janet Yellen’s semiannual testimony before Congress alleviated some investor concerns that the central bank will start to raise interest rates sooner than expected, triggering a rally in intermediate- and long-term U.S. Treasuries. The yield on the benchmark 10-year Treasury note decreased below 2.0% early in the week. Yellen said that the Fed will begin to evaluate an initial interest rate hike on a “meeting-by-meeting basis,” with policymakers basing their decision on the latest available economic data. Economists continue to believe that a June initial rate increase is likely, although deterioration in labor market conditions could affect the timing.

Petrobras credit rating cut to junk by Moody’s

Moody’s downgraded Petrobras, Brazil’s huge state-run oil company, by two notches to below investment grade in a surprisingly aggressive move. The rating agency cited the company’s very high debt levels as well as concerns about the corruption scandal that has plagued the firm since late last year. According to Reuters, Moody’s move on Petrobras affected the largest volume of debt outstanding of any downgrade in the last 10 years. In addition, much of Brazil’s economy is linked to Petrobras, so emerging markets debt investors began to focus on the potential for a downgrade of the country’s sovereign bonds.

Modest positive returns for municipal debt

Municipal bonds generated modest gains as new issues performed well and demand and trading in the secondary market picked up. In New Jersey, a judge ruled that a plan from Governor Chris Christie to reduce payments to the state’s pension system violated the law, reinforcing municipal market worries about New Jersey’s unfunded pension obligations.

Companies rush to sell new investment-grade debt in U.S. and Europe

The new issue market for investment-grade corporate debt continued to be busy, with companies bringing bonds to market to take advantage of the low interest rate environment. U.S. firms have also been rushing to sell new bonds in Europe, where rates are even lower. Coca-Cola sold 8.5 billion euros of bonds on Thursday in the second-largest euro-denominated debt issue ever.

Weekly Gainers %

Weekly Losers %

Economic Events

This week’s IPO’s

This week’s notable earnings with a Float minimum of 10%

Top 20 Percentage Float Short

Currencies

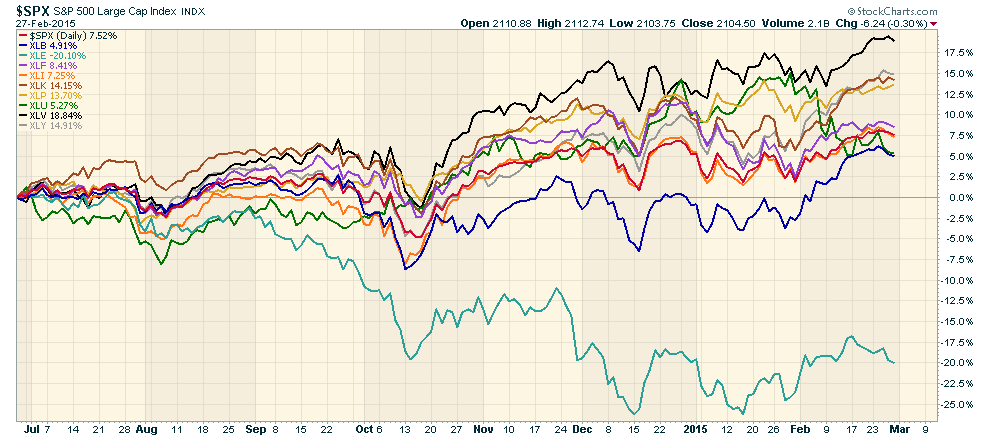

Sectors

The Consumer Staples Sector leads the way for the week.

Industry Charts

The top Industry in the Consumer Staples Sector for the week was $DJUSSD….Soft Drinks

Another to watch is $DJUSFP…Food Products

To receive this weekly report and daily market videos, SMS trade or investment alerts Private chat and so much more for you to build your portfolio.

Matt Cowell is an Investment Analyst for Facultas Capital Management and has outperformed the market for many years using technical analysis. His team at Milestone Capital Growth Portfolio is committed to producing the best options for their members.

To join the Private Club at Milestone Click Here http://milestonecapitalgrowthportfolio.com/join-us/

We will see you on the other side.

http://milestonecapitalgrowthportfolio.com/ , its affiliates and partners, shall have no liability for investment or other decisions based upon any Content and/or decisions based upon a contrarian view of any Content. The Content is to be used for informational and entertainment purposes only and we cannot provide investment advice for any individual. We advise that you contact your personal broker before making any investment related to any information received from the Site. http://milestonecapitalgrowthportfolio.com/ , its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter.

More Information http://milestonecapitalgrowthportfolio.com/terms-conditions-of-use/

TEAM “MCGP”