March 8, 2015 Vol. 106

Week in Review

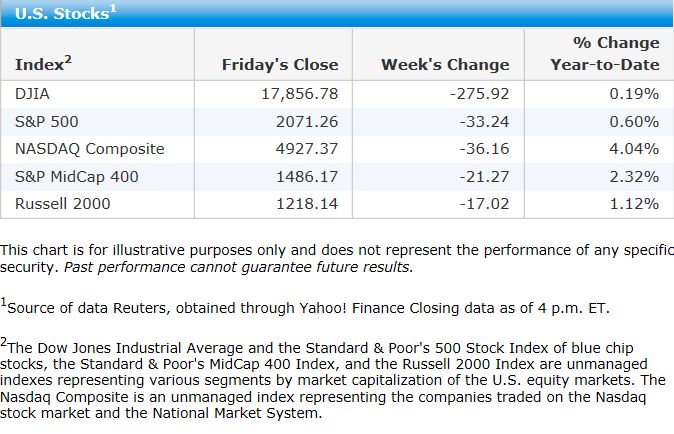

Stocks pull back following strong jobs report Stocks declined for the second straight week. A sharp sell-off followed Friday’s strong monthly jobs report, which appeared to increase the likelihood that the Federal Reserve will increase interest rates sooner rather than later. Typically defensive, dividend-paying sectors such as utilities performed poorly as investors anticipated that their appeal would diminish in the face of higher yields from fixed income securities.

After 15 years, Nasdaq climbs above 5,000 again On Monday, the technology-laden Nasdaq Composite Index closed above 5,000 for the first time since 2000 and stood within one percentage point of its all-time closing high—although more than two percentage points off its intraday peak. The benchmark gave back some of these gains later in the week but fared better than its peers thanks to some strength in Apple, which represents roughly a tenth of the index. Apple’s stock defied the Friday downdraft, seemingly due to the announcement that the company would replace AT&T as one of the 30 firms in the Dow Jones Industrial Average.

Bad weather does not slow job gains With fourth-quarter earnings reporting season nearly over, economic conditions and Fed policy appeared to move back to the fore in driving investor sentiment. Throughout the week, investors eagerly awaited the Commerce Department’s monthly payrolls report, considered by many to be the most important gauge of economic health. The unofficial tally of private sector job gains from payroll processing firm ADP, released Wednesday, proved moderately disappointing and may have lowered expectations for the Department of Labor report. On Friday morning, however, the government announced that employers added nearly 295,000 jobs in February—an especially good showing given tough weather in much of the country and widespread layoffs in the energy sector.

Despite weak nominal earnings gains, a change in Fed policy may be coming Stocks initially wavered on the jobs report, perhaps because the very modest wage gains also included in the report suggest that inflation pressures will remain minimal. By mid-morning, however, a consensus appeared to emerge that the improving labor market would lead the Fed to increase short-term rates as early as this summer. Economists note that real wages (accounting for inflation) are growing at a less sluggish pace than the nominal figures suggest, and they believe that a signal about a change in Fed policy may soon be at hand. The Fed’s next monetary policy meeting will be held on March 17-18.

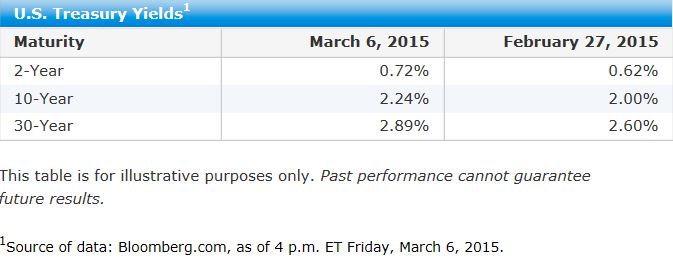

Strong February U.S. employment numbers lead to sell-off in Treasuries Another strong monthly employment report suggested that the Federal Reserve’s first interest rate increase will come sooner rather than later this year, leading fixed income investors to sell U.S. Treasuries. The February nonfarm payrolls data showed a better-than-expected 295,000 jobs added, while the unemployment rate dropped to 5.5% from 5.7% in January. The yield on the benchmark 10-year U.S. Treasury note increased above the level where it started 2015. (Bond prices and yields move in opposite directions.)

ECB to start buying sovereign debt next week The yield premium offered by the 10-year U.S. Treasury note over 10-year German government debt reached a record high as the European Central Bank’s announcement that it will begin buying sovereign bonds next week pushed eurozone sovereign yields lower. Mario Draghi, the central bank’s president, said that it will buy bonds with negative yields as long as they are above the bank’s -0.2% deposit rate.

Flood of new investment-grade corporate bond issuance continues New issuance continued to pour into the investment-grade corporate debt market, with the new deals oversubscribed amid strong investor demand for yield. Pharmaceutical company Actavis sold $21 billion of debt, the second-largest corporate bond offering ever, to fund its acquisition of Allergan, maker of Botox. In Europe, French utility GDF Suez sold €500 million of investment-grade notes with a 0% coupon, becoming the first company in more than 14 years to sell euro-denominated debt with no regular interest payments.

China and India cut interest rates Emerging markets debt posted broadly negative returns in light trading ahead of the ECB announcement and Friday’s U.S. employment report. Higher-rated emerging markets bonds, including the sovereign debt of Mexico, Columbia, and Peru, sold off along with U.S. Treasuries. Last weekend, China’s central bank cut interest rates for the second time in four months in an effort to stimulate more economic growth. The central bank of India followed suit during the week, lowering its benchmark lending rate for the second time in 2015 and citing economic weakness in certain sectors.

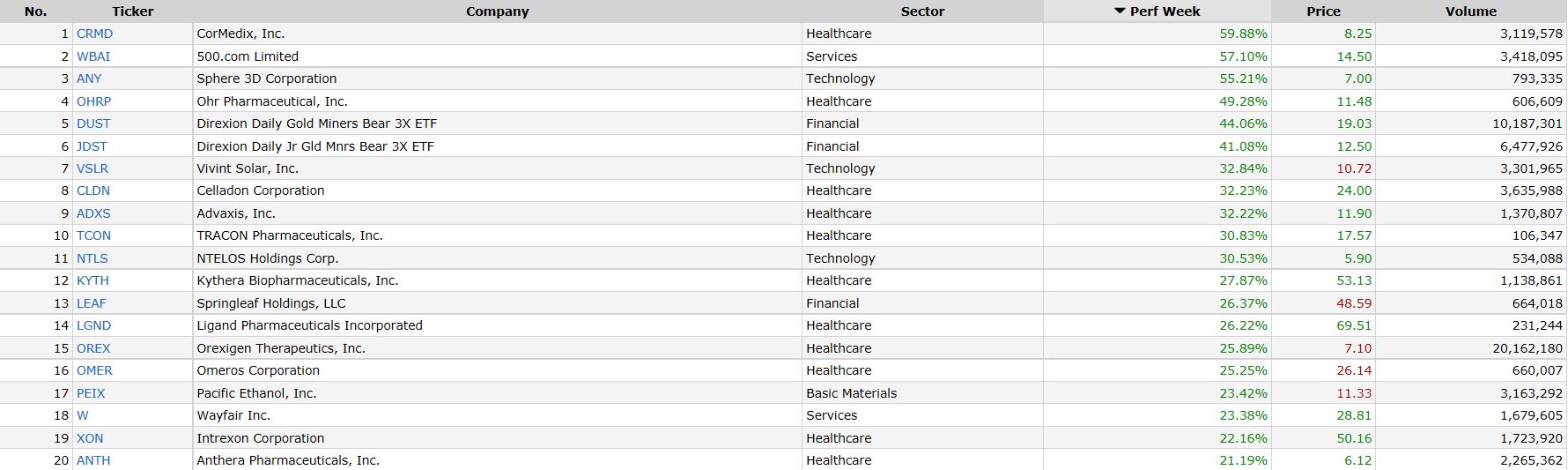

Weekly Gainers %

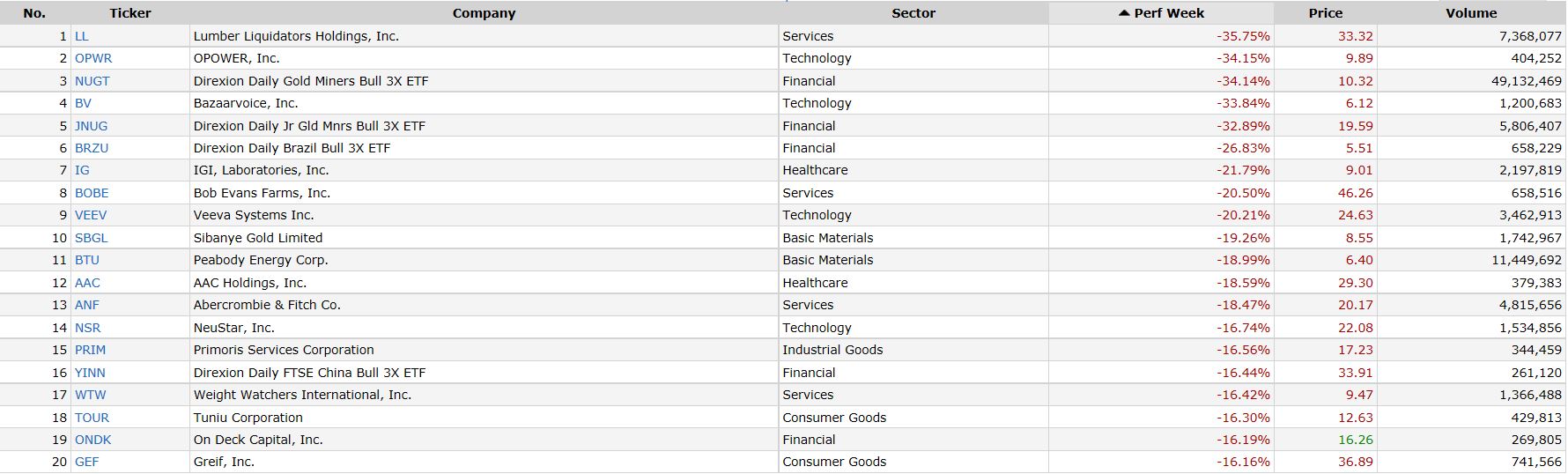

Weekly Losers %

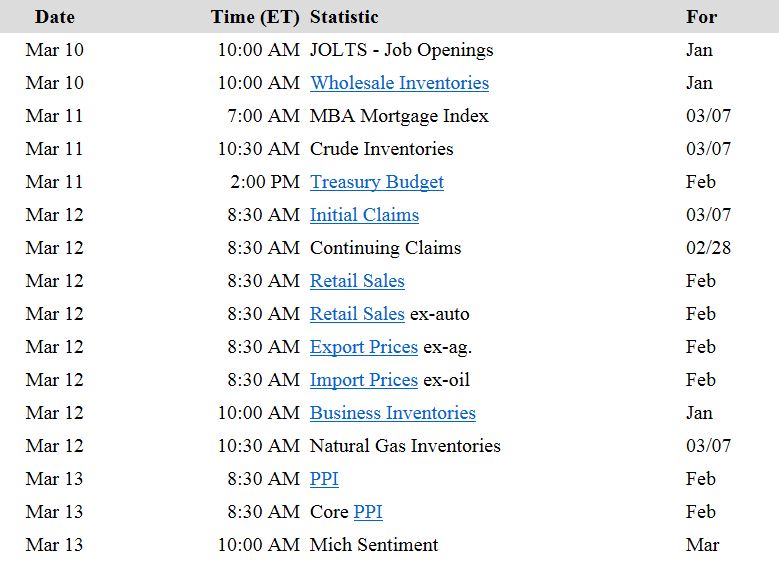

Economic Events

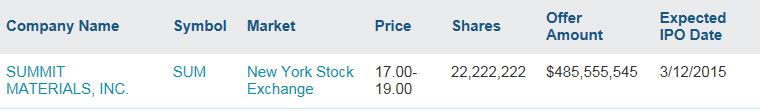

This week’s IPO’s

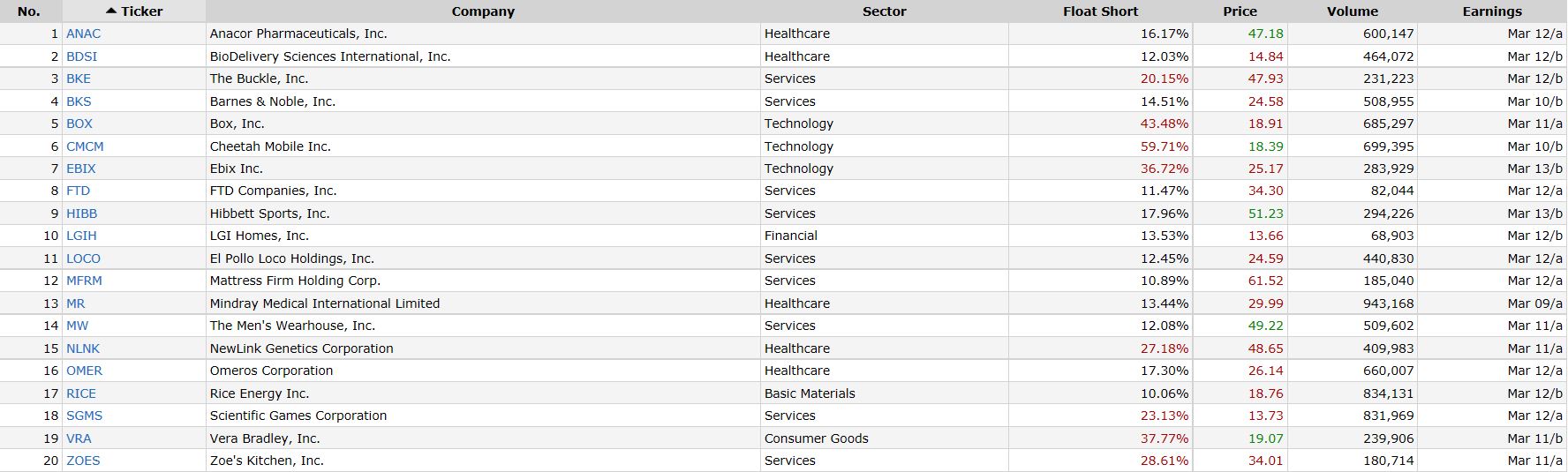

This week’s notable earnings with a Float minimum of 10%

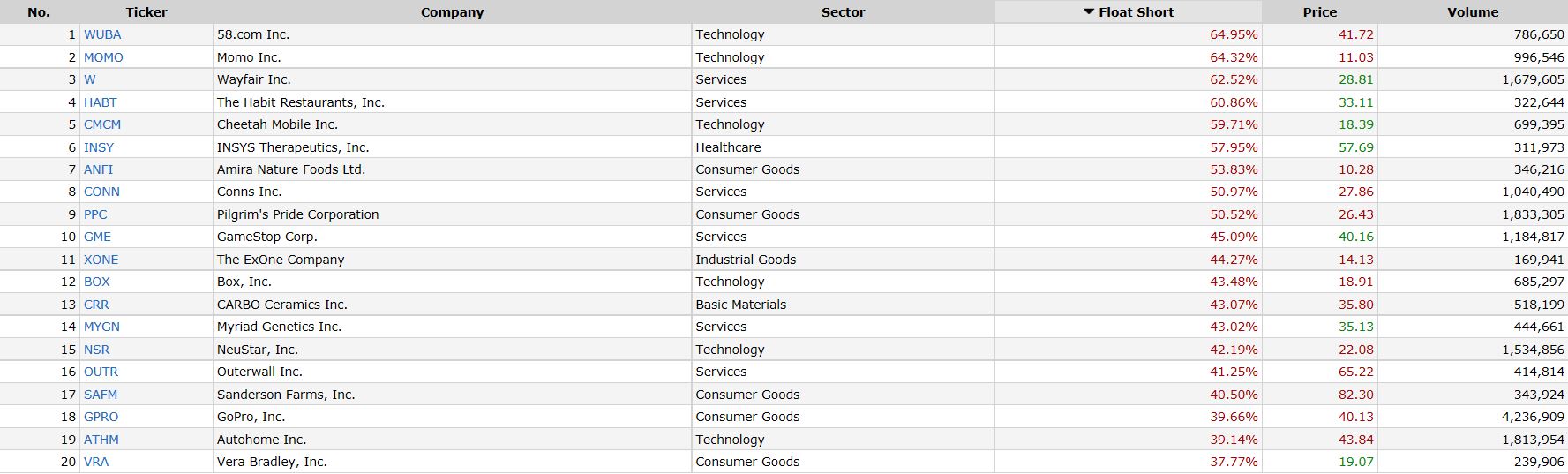

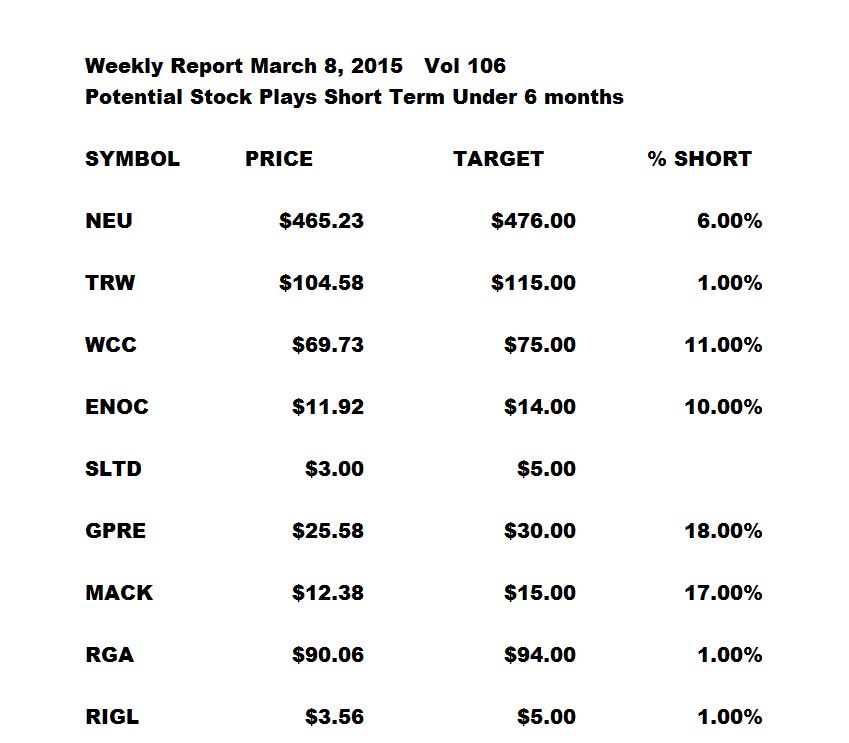

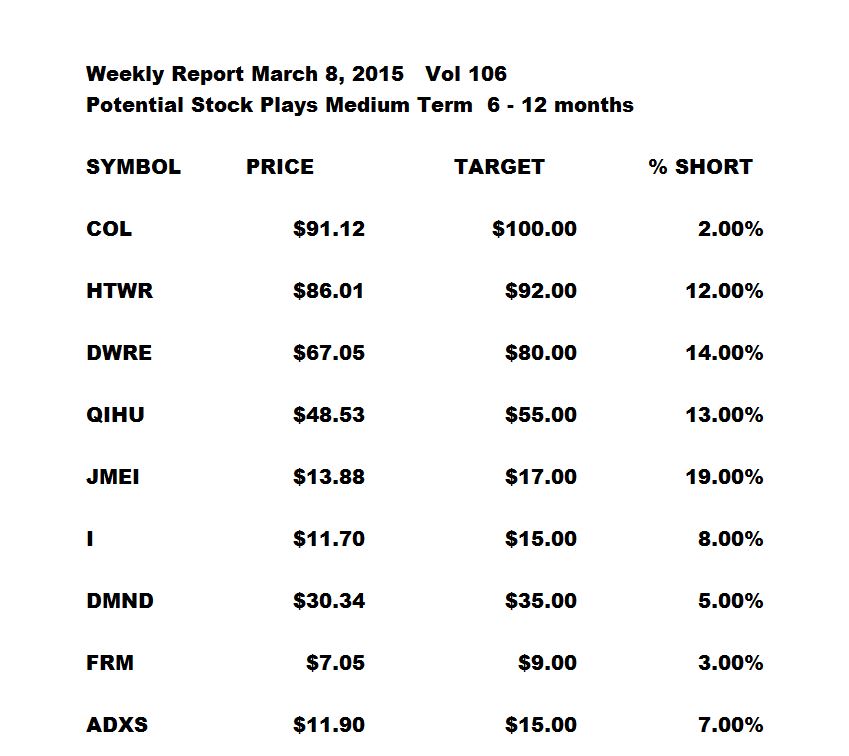

Top 20 Percentage Float Short

Currencies

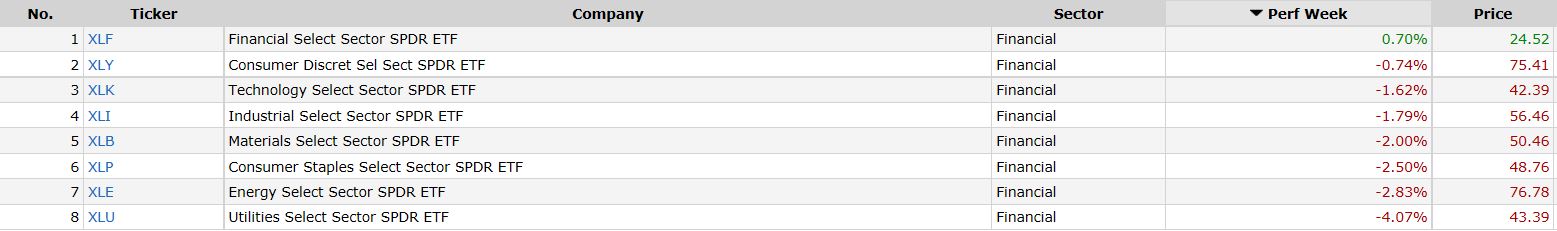

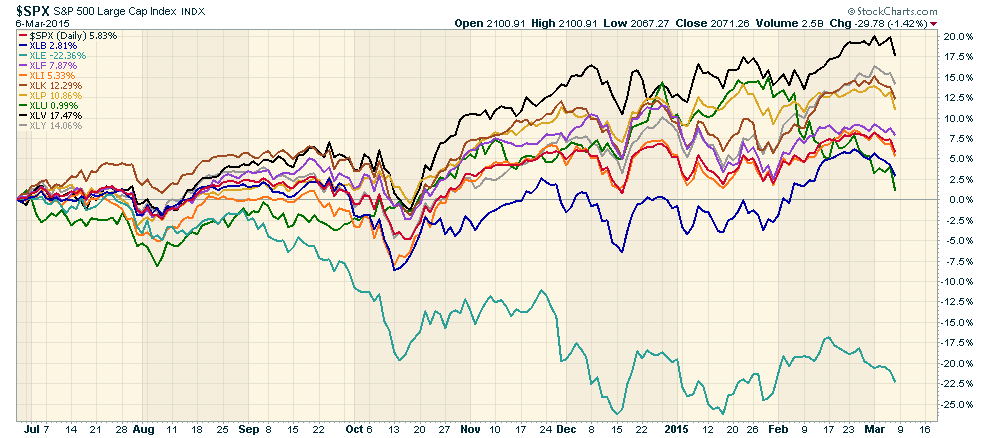

Sectors

The Financial Sector leads the way for the week

Industry Charts

The top Industry in the Financial Sector for the week was $DJUSIL…Life Insurance

A chart to watch in the above Industry…EHTH

To receive this weekly report and daily market videos, SMS trade or investment alerts Private chat and so much more for you to build your portfolio.

Matt Cowell is an Investment Analyst for Facultas Capital Management and has outperformed the market for many years using technical analysis. His team at Milestone Capital Growth Portfolio is committed to producing the best options for their members.

To join the Private Club at Milestone Click Here http://milestonecapitalgrowthportfolio.com/join-us/

We will see you on the other side.

http://milestonecapitalgrowthportfolio.com/ , its affiliates and partners, shall have no liability for investment or other decisions based upon any Content and/or decisions based upon a contrarian view of any Content. The Content is to be used for informational and entertainment purposes only and we cannot provide investment advice for any individual. We advise that you contact your personal broker before making any investment related to any information received from the Site. http://milestonecapitalgrowthportfolio.com/ , its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter.

More Information http://milestonecapitalgrowthportfolio.com/terms-conditions-of-use/

TEAM “MCGP”