April 5, 2015 Vol. 109

Week in Review

Week Ended April 2, 2015

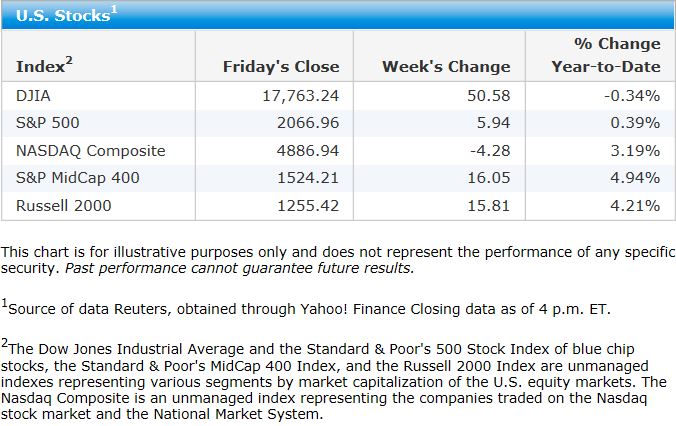

Stocks slightly higher in short trading week

Stock prices were mixed for the holiday-shortened week. The smaller-cap benchmarks saw decent gains and outpaced the large-cap benchmarks, while the technology-heavy Nasdaq Composite was slightly lower. Trading for the week ended Thursday due to the market’s closure for Good Friday—as a result, U.S. markets will not react until Monday to the Commerce Department’s closely watched monthly payrolls report, scheduled for release on Friday morning.

Health care stocks fall back on billing inquiry

Markets started the week on a strong note, building on a partial turnaround that had begun the previous Friday. News of important mergers helped drive good gains in the health care sector. The sector gave back these gains on Thursday, however, due in part to news that a large hospital operator was the subject of a government investigation relating to its billing practices.

U.S. manufacturing data proves disappointing

Disappointing economic data at midweek also weighed on sentiment. On Tuesday, a gauge of business activity in the Midwest showed a slowdown in the manufacturing-heavy region. Slowing growth in factory activity was confirmed Wednesday by the Institute for Supply Management’s purchasing managers index, which declined for the fifth month in a row—although it remained slightly positive. The Commerce Department offered slightly better manufacturing news on Thursday, when it announced that factory orders had crept upward in February for the first time in several months.

European manufacturing gains

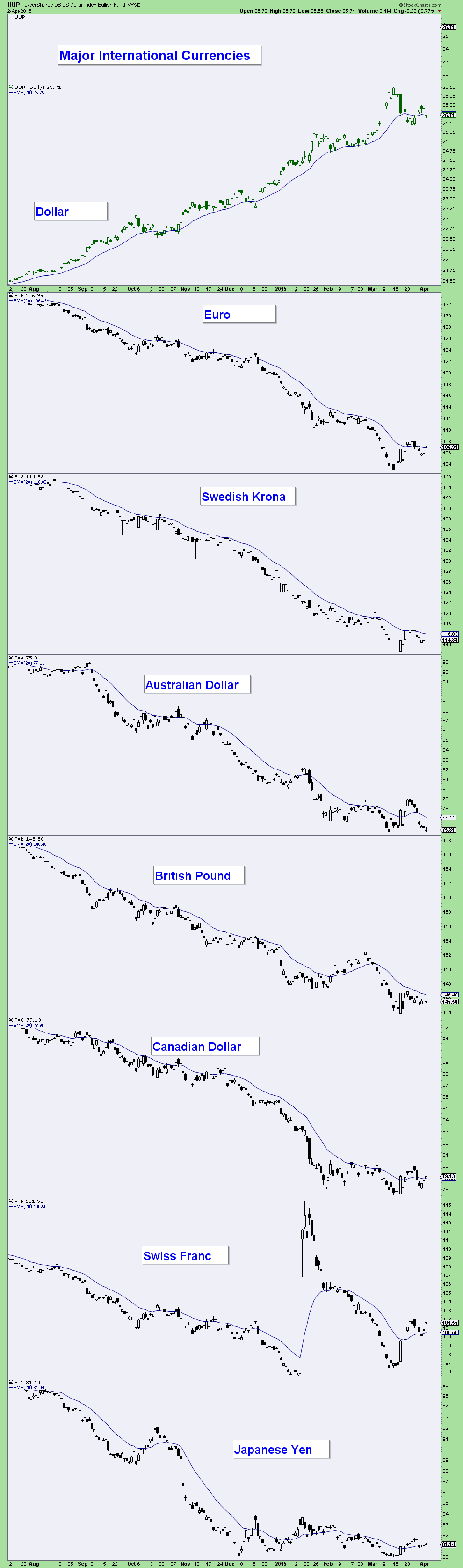

The overall tone of the manufacturing data appeared to confirm that U.S. firms were struggling with the strong U.S. dollar, which makes their goods less competitive on global markets. Conversely, European manufacturing data came in slightly stronger than expected, indicating that firms overseas may be taking some market share. U.S. Economists note that severe weather and port disruptions on the West Coast have also recently weighed on manufacturing output.

Strong dollar weighs especially heavy on large-caps

Analysts observe that the strong dollar is taking a disproportionate toll on the earnings of large-cap companies in the S&P 500, which get well over one-third of their revenues from overseas. In contrast, the small-cap companies in the Russell 2000 Index get roughly one-fifth of their revenues from foreign sales. In the final quarter of 2014, small-cap companies enjoyed more than three times the earnings growth and over five times the sales growth of their large-cap counterparts.

Weak U.S. economic data prompts rally in Treasuries

Some weaker-than-expected U.S. economic data led more investors to believe that the Federal Reserve will wait longer to tighten monetary policy, triggering a rally in U.S. Treasuries. The ADP National Employment report for March showed the smallest number of workers added to private payrolls in over a year. Also, the Institute for Supply Management’s factory activity index declined to its lowest level since May 2013. In the eurozone, worries about deflation eased somewhat as headline consumer prices declined 0.1% in March from a year earlier, an improvement from the 0.3% annual drop in February. However, the impasse between Greece and its creditors about freeing up funding drove the yield on 10-year Greek sovereign debt over 11%.

Positive news from Brazil lifts emerging markets debt

Emerging markets bonds generated positive returns and outperformed U.S. Treasuries. In Brazil, President Dilma Rousseff introduced fiscal austerity measures that were well received by investors in the country’s debt, although not by its citizens. She also said that Petrobras, Brazil’s state-owned oil company, will produce financial statements that account for the effects of a bribery scandal by the end of April, allowing it to avoid a technical default.

Municipal bonds lag Treasuries

Heavy issuance continued to weigh on the municipal bond market, which lagged the rally in Treasuries in light trading. Municipal bond investors have been closely monitoring the financial situation of Puerto Rico and its public utilities, which are major issuers of municipal debt. The Puerto Rico Electric Power Authority, the U.S. territory’s financially troubled electric utility, reached an agreement with its creditors to extend a loan repayment deadline by 15 days.

Gains for corporate bonds

Investment-grade and high yield corporate bonds generated gains. Higher oil prices supported the high yield market, where bonds from oil-related issuers account for a large proportion of most indexes. In particular, higher-quality noninvestment-grade issuers in the energy sector experienced solid demand. The week was the slowest of 2015 in terms of issuance of investment-grade corporate debt, which helped move that market toward a healthier balance of supply and demand.

Also of note is that Futures were down 165 after Friday’s job reports.

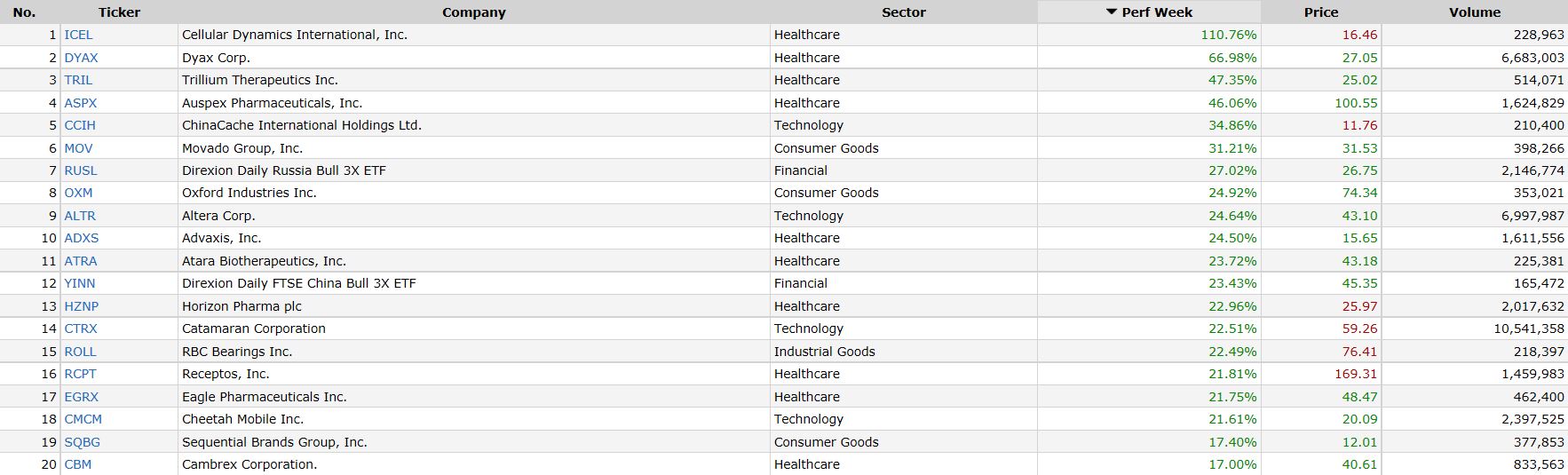

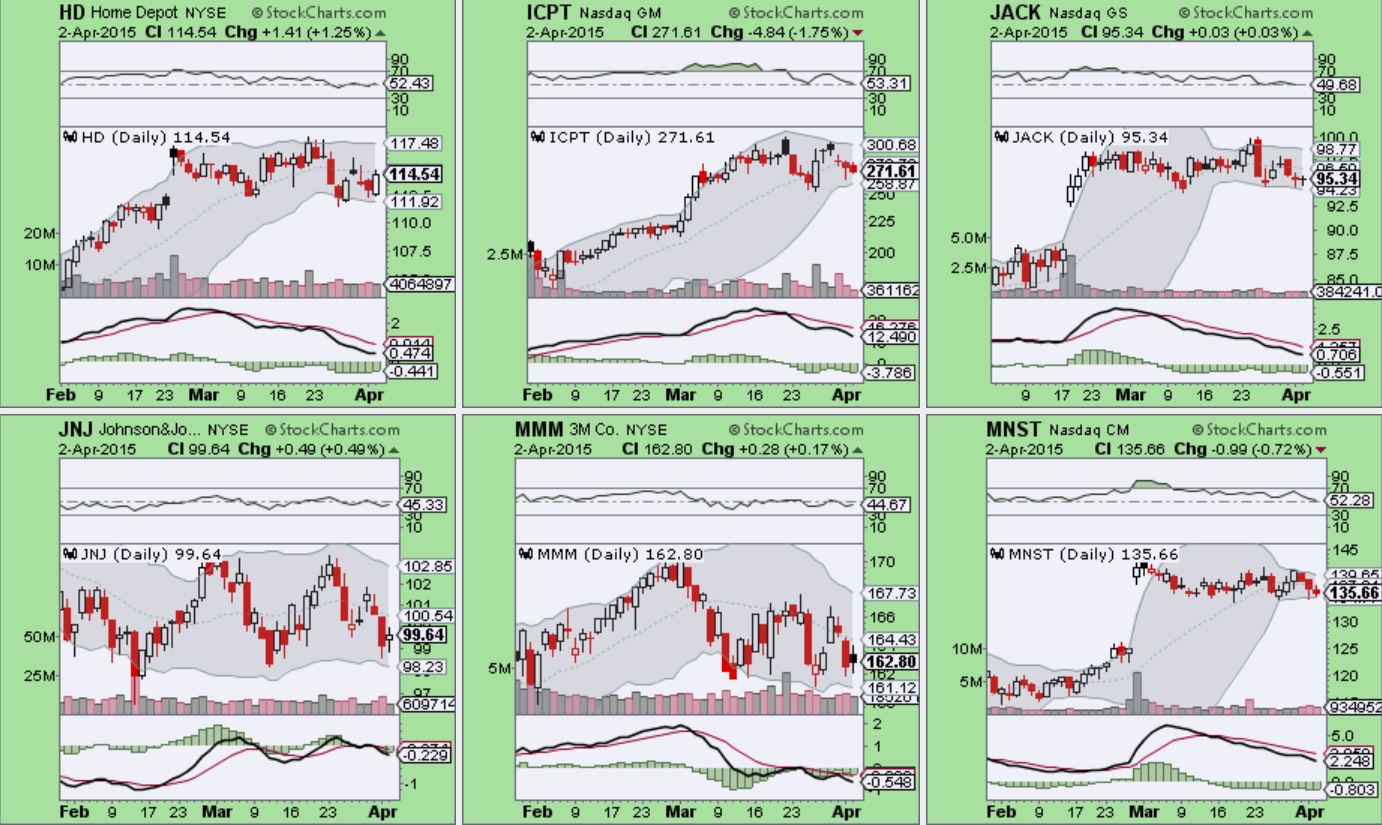

Weekly Gainers %

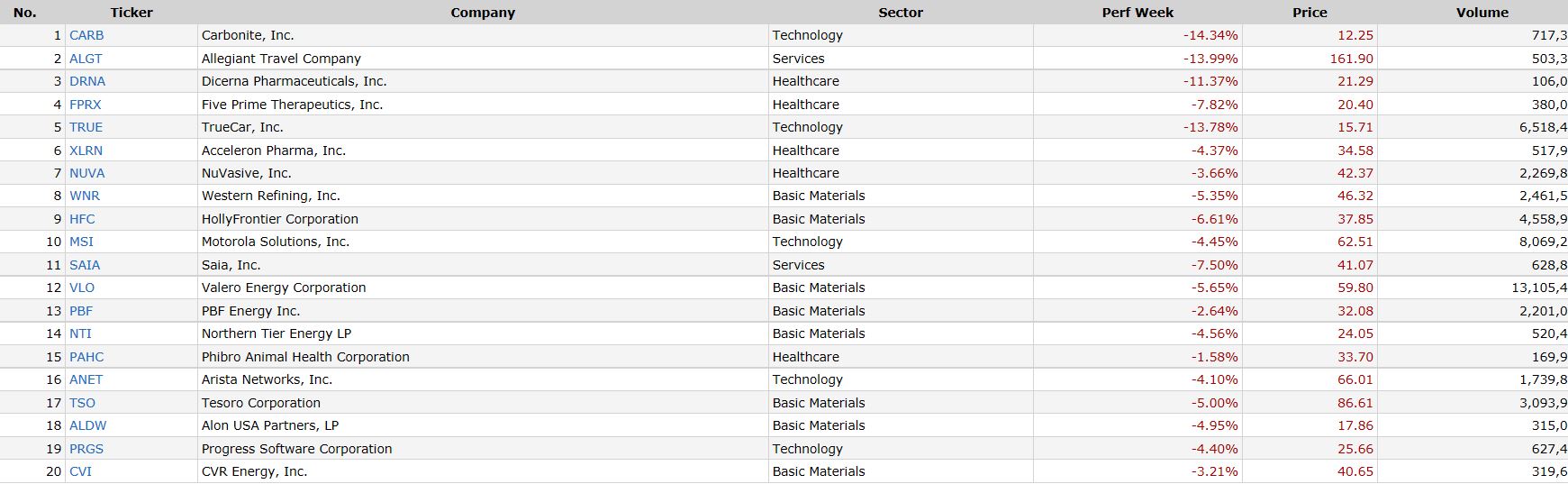

Weekly Losers %

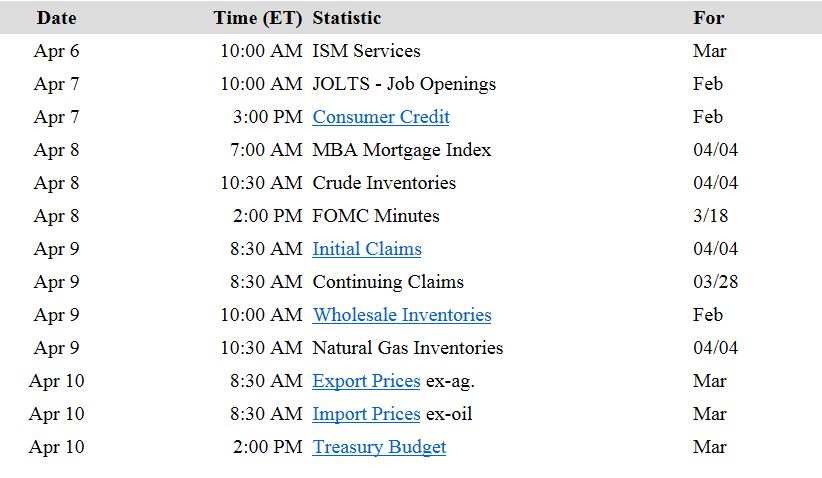

Economic Events

No IPO’s listed for this week.

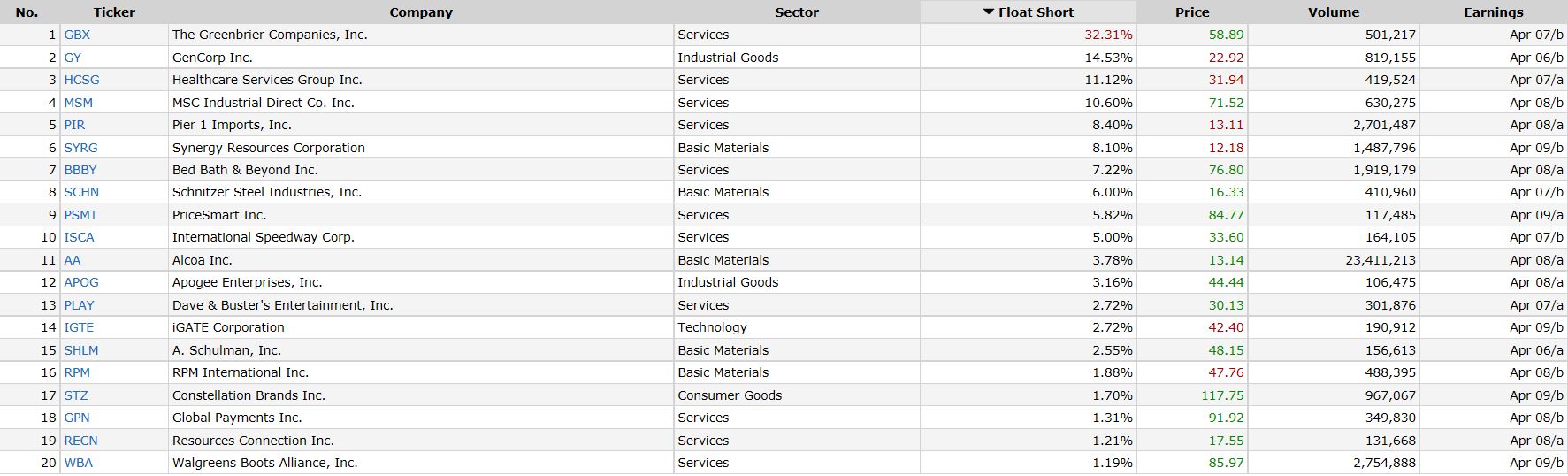

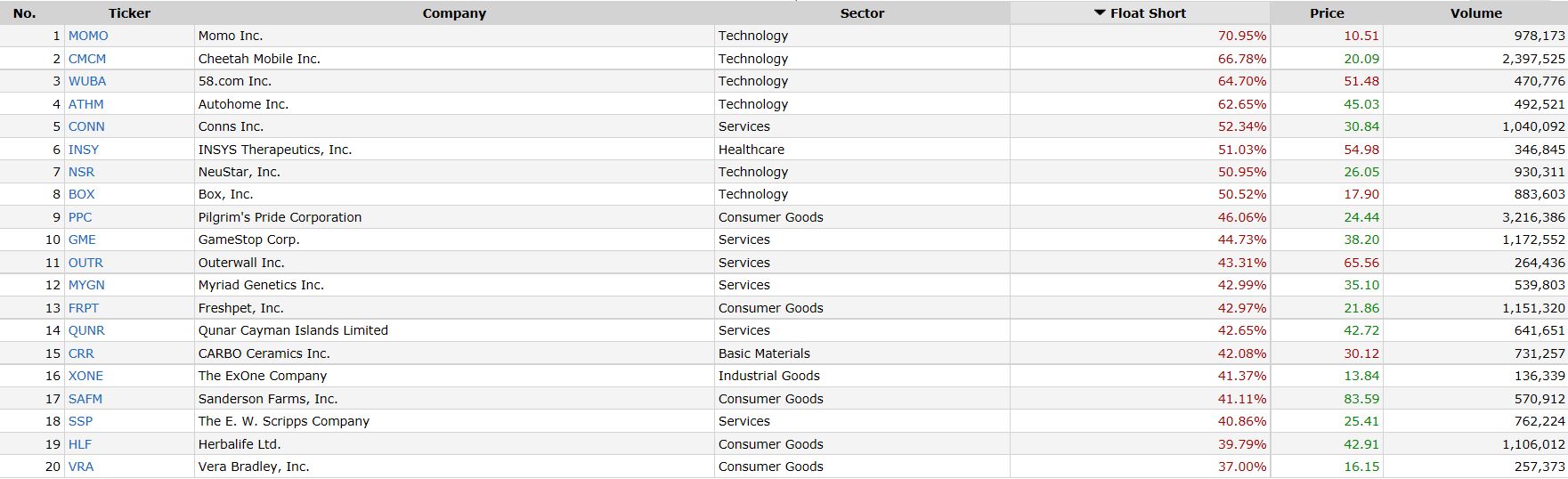

This week’s notable earnings with a Short Float

Top 20 Percentage Float Short

Currencies

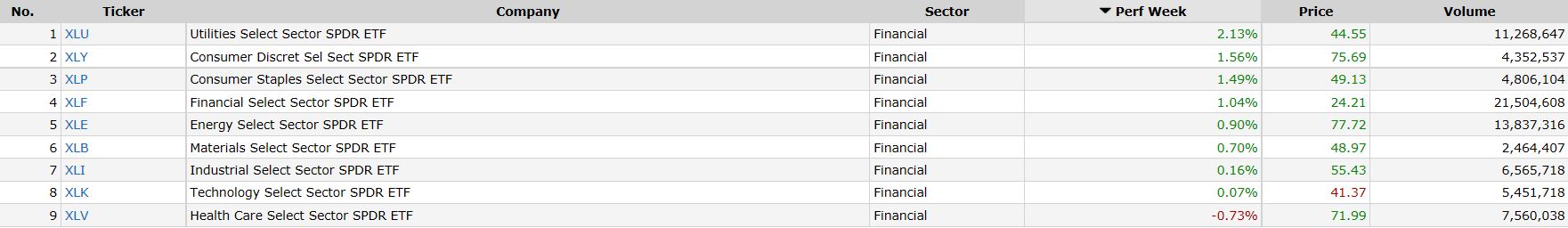

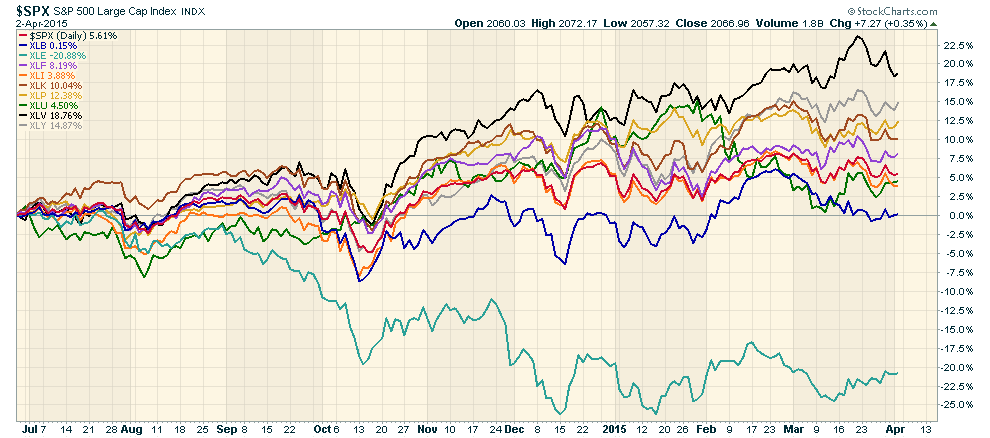

Sectors

To receive this weekly report and daily market videos, SMS trade or investment alerts Private chat and so much more for you to build your portfolio.

Matt Cowell is an Investment Analyst for Facultas Capital Management and has outperformed the market for many years using technical analysis. His team at Milestone Capital Growth Portfolio is committed to producing the best options for their members.

To join the Private Club at Milestone Click Here http://milestonecapitalgrowthportfolio.com/join-us/

We will see you on the other side.

http://milestonecapitalgrowthportfolio.com/ , its affiliates and partners, shall have no liability for investment or other decisions based upon any Content and/or decisions based upon a contrarian view of any Content. The Content is to be used for informational and entertainment purposes only and we cannot provide investment advice for any individual. We advise that you contact your personal broker before making any investment related to any information received from the Site. http://milestonecapitalgrowthportfolio.com/ , its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter.

More Information http://milestonecapitalgrowthportfolio.com/terms-conditions-of-use/

Team”MCGP”