March 29, 2015 Vol. 108

Week in Review

There was no weekly report for last week due to travel conflicts.

Week Ended March 27, 2015

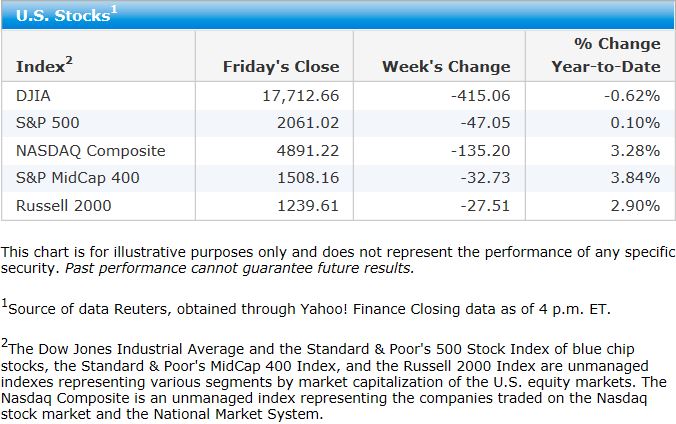

U.S. stocks post weekly decline; Dow erases 2015 gains

U.S. stocks fell this week as a batch of disappointing data stirred worries about slowing economic and earnings growth just before the start of the quarterly earnings season. The Dow Jones Industrial Average and the Standard & Poor’s 500 Index each fell every day this week before edging higher on Friday. The four-day sell-off marked the S&P 500’s longest slide since mid-January, according to Bloomberg, and pushed the Dow into the red for the year. Trading activity was relatively muted, with Monday and Tuesday ranking among the lowest-volume trading days this year.

Commerce data cast doubt on recovery

A few downbeat economic reports raised doubts about the strength of the current recovery. The U.S. economy expanded at a seasonally adjusted 2.2% annual rate in last year’s final quarter, the Commerce Department reported Friday. While the latest gross domestic product reading matched the Commerce Department’s prior estimate, it also showed that U.S. corporate profits posted their biggest quarterly drop in four years. For all of 2014, corporate profits fell 0.8%, the first annual decrease since 2008. Separately, durable goods orders unexpectedly tumbled in February, the latest indicator that U.S. economic growth stalled early this year.

Strong dollar, lower oil to impact earnings beyond 2015

February’s durable goods report also showed that U.S. business investment spending fell for the sixth straight month, highlighting the hurtful impact of a strong dollar and lower crude oil prices on many U.S. multinational companies. Analysts believe that U.S. dollar appreciation and falling oil prices will remain significant drivers for corporate earnings for several quarters to come, though the impact will vary according to sector. Earnings for the S&P 500 are expected to increase 2.2% in 2015, according to FactSet, driven by earnings growth in every sector except for energy, whose earnings are forecast to tumble 55% this year.

Return of volatility positive for active managers

Analysts also note that the CBOE Volatility Index-a gauge of expected volatility for the S&P 500 also known as the “investor fear gauge”-is approaching its historical average, after dipping to atypically low levels in recent years. Because heightened volatility creates more opportunities to buy and sell stocks at attractive prices, we are encouraged by the recent uptick in volatility, which favors active portfolio management. The increase in volatility coincides with gauges showing falling correlations in the stock market, which is also positive for active managers.

Weak demand at Treasury note auctions leads to higher yields

Intermediate- and long-term U.S. Treasury debt prices fell, pushing yields higher and ending a two-week rally. (Bond prices and yields move in opposite directions.) Early in the week, Treasury prices climbed after the Commerce Department reported that February durable goods orders were lower than expected. However, yields finished the week higher after auctions of five- and seven-year Treasury notes showed relatively weak investor demand for the new debt.

Positive results for investment-grade corporate debt despite ongoing supply pressure

Investment-grade corporate bonds were resilient in the face of weakness in equities and an ongoing flow of new supply, which was somewhat more subdued than in recent weeks. Kraft Foods, an investment-grade company, and Heinz, a high yield issuer, announced that they will merge to create the third-largest North American food company in a transaction that typically would hurt the credit quality of the investment-grade firm. However, Kraft’s management stated that the deal will be structured to allow Kraft to keep its investment-grade credit ratings.

High yield bonds gain from uptick in oil prices

An increase in oil prices amid rising geopolitical tensions in the Middle East helped support high yield bonds, which posted positive returns for the week despite a busy new issue calendar. Bonds from oil-related issuers account for a large proportion of most high yield indexes. Heinz’s bonds rallied on the news of the company’s merger with higher-rated Kraft.

Petrobras looks likely to avoid technical default

Emerging markets debt generated gains for the week as the prices of bonds issued by Petrobras, Brazil’s state-owned oil company that is embroiled in a corruption scandal, climbed after regulators approved the firm’s method of accounting for bribes. The ruling should allow Petrobras to file financial reports by the end of April to avoid a technical default. Standard & Poor’s reaffirmed its BBB- credit rating on Brazil’s sovereign bonds. Sovereign debt analysts have been pleased with the country’s efforts to make its fiscal policy more responsible following last year’s election.

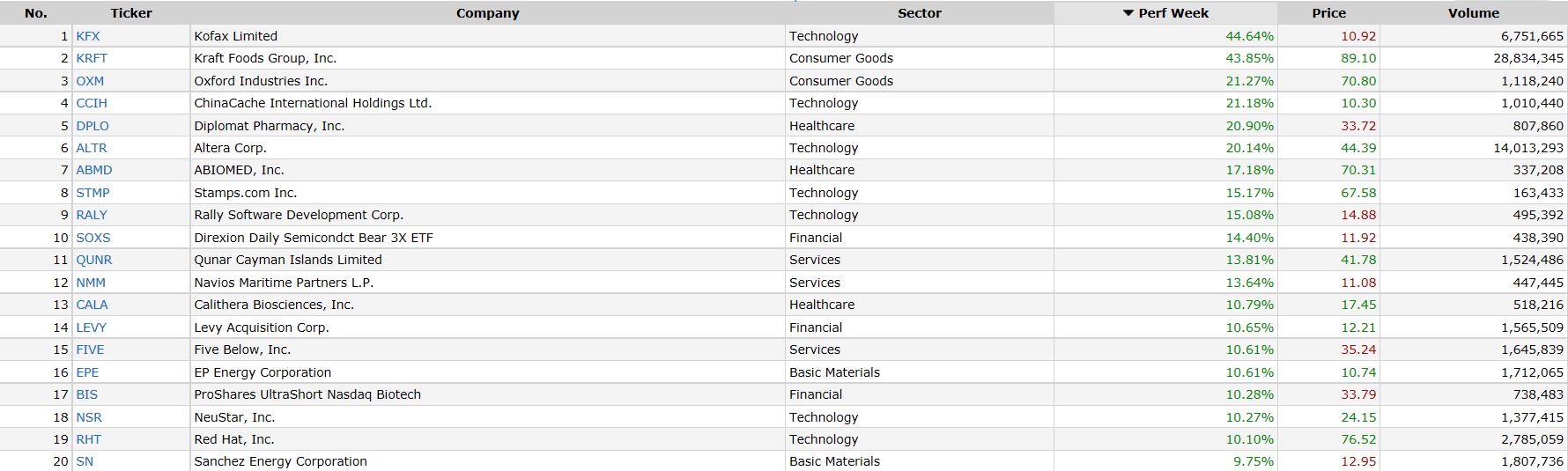

Weekly Gainers %

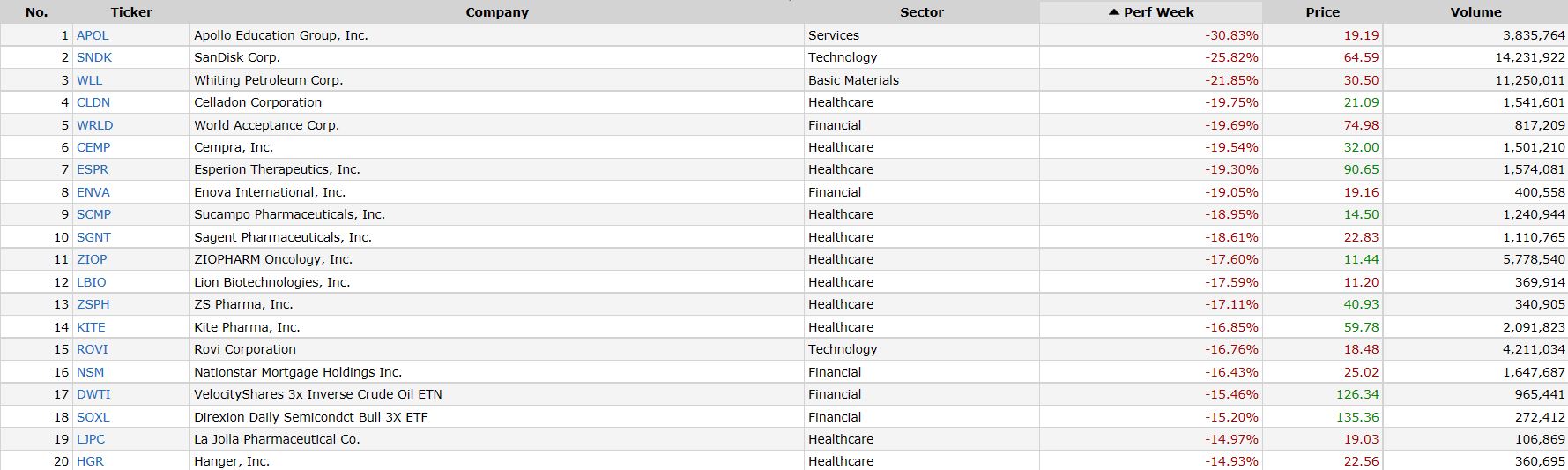

Weekly Losers %

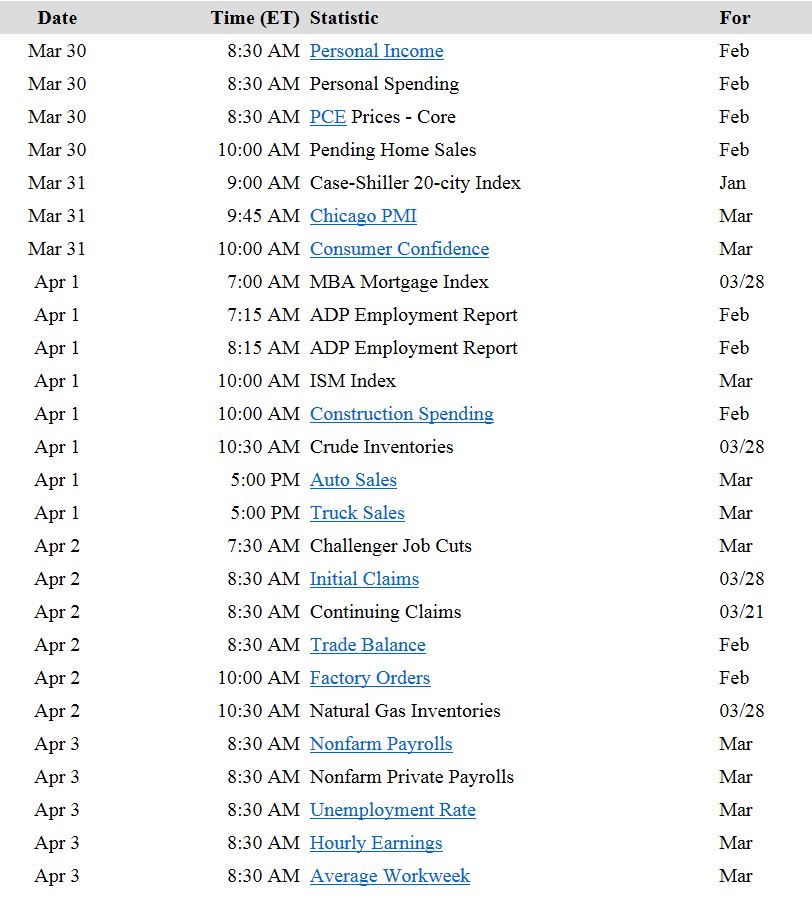

Economic Events

Upcoming IPO’s

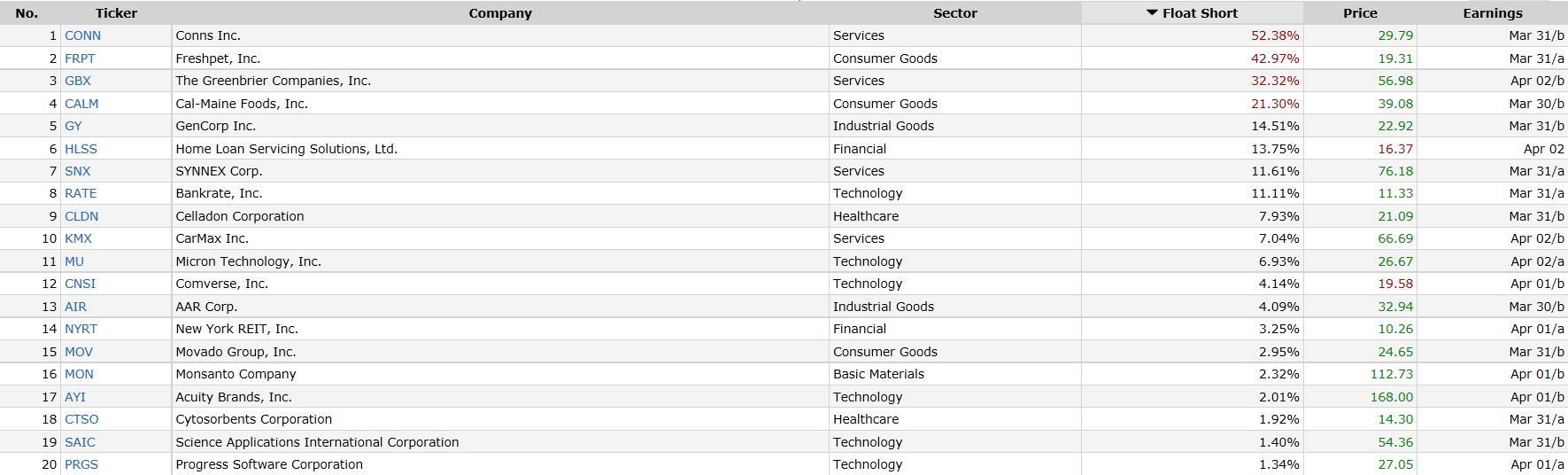

This week’s notable earnings with a Short Float

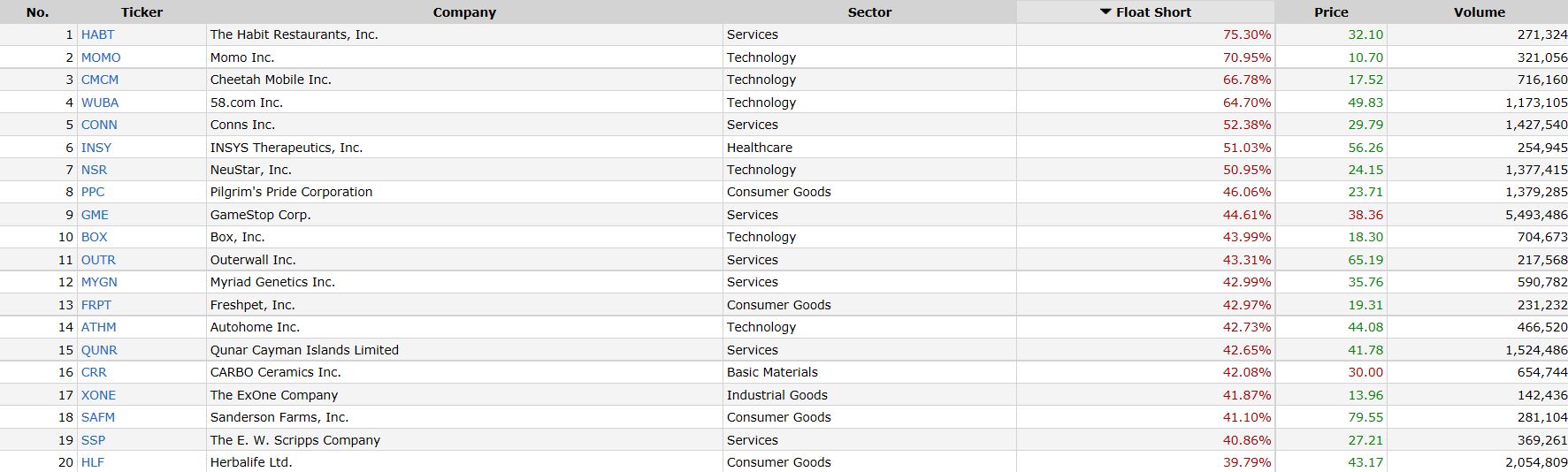

Top 20 Percentage Float Short

Currencies

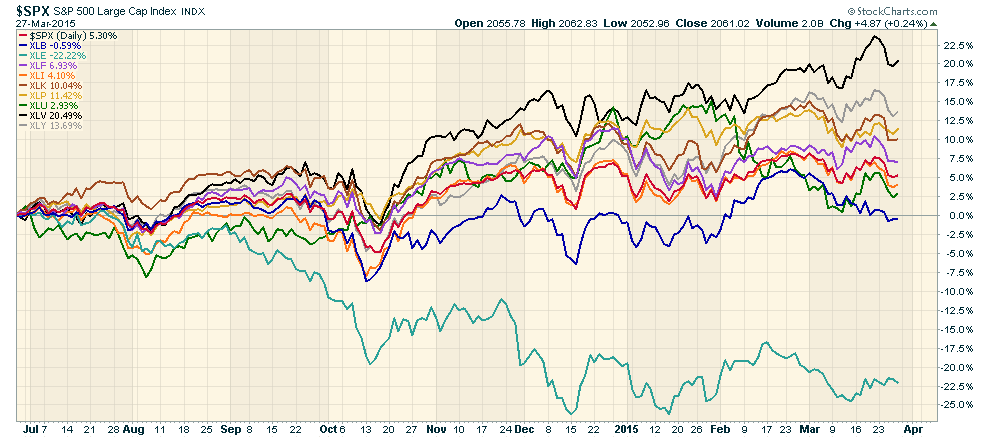

Sectors

All sectors were down for the week.

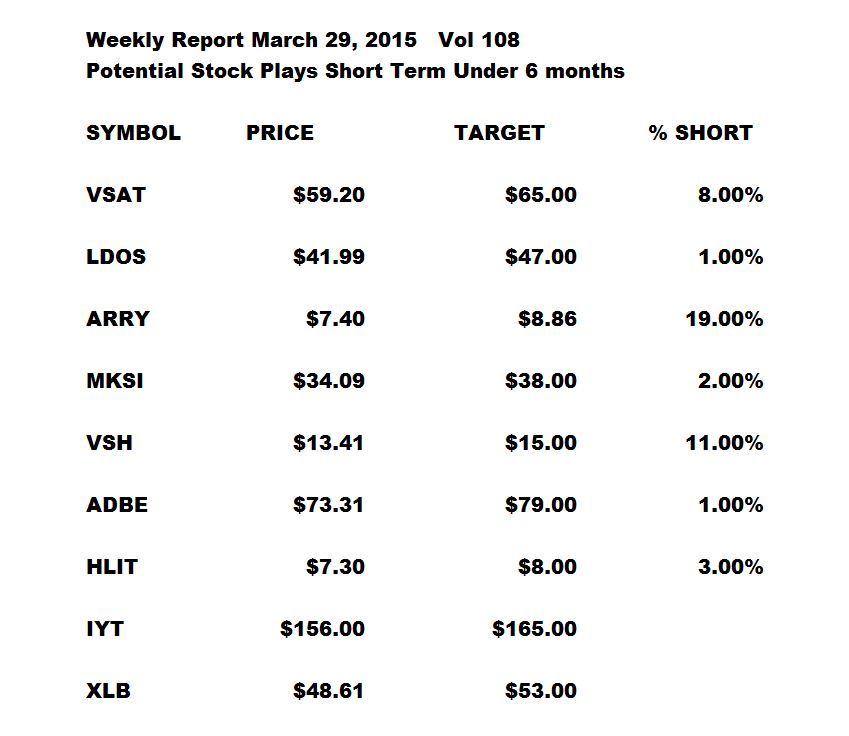

To receive this weekly report and daily market videos, SMS trade or investment alerts Private chat and so much more for you to build your portfolio.

Matt Cowell is an Investment Analyst for Facultas Capital Management and has outperformed the market for many years using technical analysis. His team at Milestone Capital Growth Portfolio is committed to producing the best options for their members.

To join the Private Club at Milestone Click Here http://milestonecapitalgrowthportfolio.com/join-us/

We will see you on the other side.

http://milestonecapitalgrowthportfolio.com/ , its affiliates and partners, shall have no liability for investment or other decisions based upon any Content and/or decisions based upon a contrarian view of any Content. The Content is to be used for informational and entertainment purposes only and we cannot provide investment advice for any individual. We advise that you contact your personal broker before making any investment related to any information received from the Site. http://milestonecapitalgrowthportfolio.com/ , its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter.

More Information http://milestonecapitalgrowthportfolio.com/terms-conditions-of-use/

Team”MCGP”